Business Accounting

Main Feature Set

Business Accounting

The design philosophy underlying Managing Director has always been to bypass needless mimicry of arcane methods designed around the limitations of paper based systems. This has allowed complete elimination of such things as the establishment of accounting periods, and the posting of transactions to general ledger accounts. The result has been the development of accounting functions which are far more intuitive, accessible, and flexible than otherwise would be possible. If desired, Managing Director permits the responsibility for accounting related tasks to be distributed throughout the firm while security and accountability are maintained.

Managing Director records the date Payments are made, and Users identify the “Type” of Payments which often corresponds to a category of tax deduction. If necessary, the default tax deductibility of any individual Payment may be overridden permitting great flexibility. Business bank account checks may be defined as “Multiple Type” and divided into any number of “Sub-Checks,” each of which is individually assigned a Payment Type and Tax Deductibility. The date of Receipts is likewise recorded, and the Taxability of each Receipt is individually set.

To facilitate tax accounting and business planning, a self configuring Income Statement is accessible to Director level Users. This income statement defaults to a period from the beginning of the current calendar year through the end of the current calendar month, and can be set to any period of days for which accounting data have been entered by editing the default dates. The amounts reported are compiled from the original Payment and Receipt records. One column displays income and expense totals for the time period specified, and a second column automatically annualizes the first. The form of the Income Statement is patterned after the structure of an income tax return making the transfer of figures to the actual return simple and convenient. Most firms need only supplement these figures with depreciation and amortization schedules prepared on an annual basis.

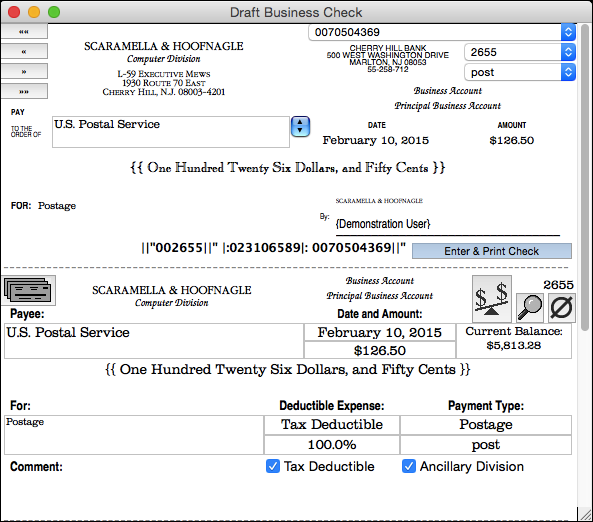

The Draft Check views appear the same as the actual check which will be printed by Managing Director, with the addition of a few pop-up menus and command buttons which do not print. The Draft Business Check view is shown below.

Managing Director is capable of handling any number of open and closed Bank Accounts. The Administrator may set a default Business Bank Account and default Trust Bank Account which will be automatically entered when a clear Business or Trust Check entry form is displayed. The User identifies the Bank Account by a User assigned Account Name which is descriptive and meaningful to the User, rather than by the Account Number which is only easily recognized and remembered by the computer. Yet the computer identifies the Bank Account by Account Number, which is efficient for the computer, and allows the User to later change the Account Name associated with a particular Account Number without disrupting previously stored data.

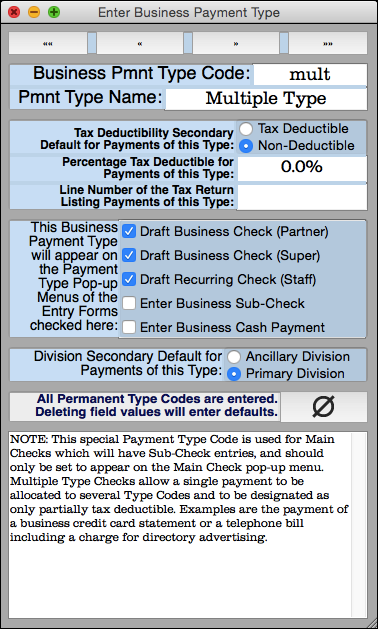

All Payment records are assigned a Payment Type by the User entering the Payment record. The Payment Type field is used to categorize Payments by type, and is identified by use of a pop-up menu which lists the Payment Type Names corresponding to Payment Type Codes. The associated Payment Type Code is entered when a Payment Type Name is selected from the menu. Managing Director allows the Administrator to edit and define Payment Type Codes and Payment Type Names which are meaningful to Users such as “rent” for “Office Rent,” or “post” for “Postage,” and to determine which Payment Types appear on the pop-up menus of different level Users in the User hierarchy. The Enter Business Payment Type view which is only accessible to the Administrator appears below. Those accustomed to more traditional accounting systems may find it helpful to think of Payment Types as virtual general ledger accounts. Payment Types essentially serve the same function, and Payment Type records include fields that determine the default Tax Deductibility, the Percentage Tax Deductible, and the Tax Return Line Number on which Tax Deductible Payments of this Payment Type will be reported.

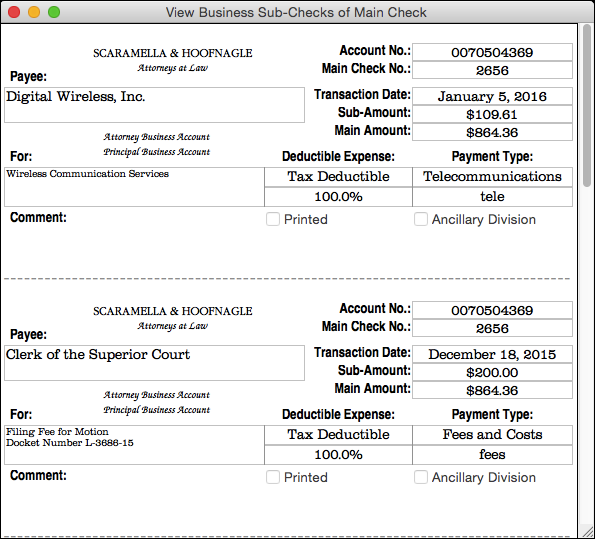

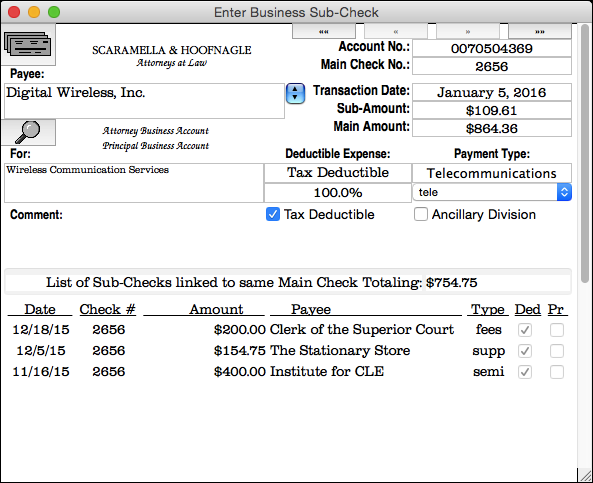

To accommodate the need to divide individual Payments made by Check into subcomponents for accounting purposes, Business Bank Account Checks may be defined as Multiple Type and divided into any number of Sub-Checks. Each Sub-Check is individually assigned a Payment Type and Tax Deductibility. The Multiple Type Main Check itself is always treated as Non-Deductible by the Income Statement, regardless of how the Tax Deductible flag field is set. A typical use of a Multiple Type Check is payment of a credit card bill. Each transaction on the statement may be entered as a separate Sub-Check allowing great flexibility in accounting for the Payment. The View Business Sub-Checks of Main Check view is shown below displaying two Sub-Checks. The Enter Business Sub-Check view is shown below as it appears just before entry of the last Sub-Check for a particular Main Check.

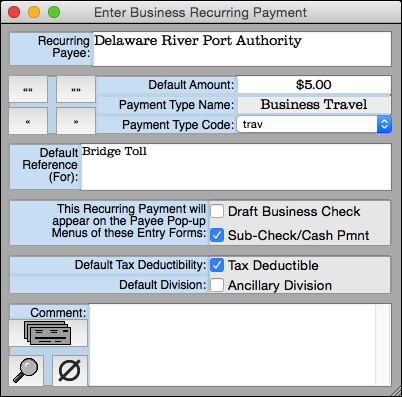

Once the Payment Type is selected while a Payment record is being entered, the Payee field may be defined by use of a pop-up menu. This menu lists only those Recurring Payees previously entered for the Payment Type by the Administrator or a Director or Bookkeeper level User, and which were set to appear on the Payment entry view being used. Restricting the listed Payees in this way keeps the pop-up menu to a manageable size even after many Recurring Payment records have been entered into Managing Director. Depending upon the level of access granted to the particular User, this field may be fully editable, or definable only by use of the pop-up menu. Staff level Users are given access only to the pop-up menu, and are thus prevented from making Payments by Check to unauthorized Payees. Since most Business Checks are made payable to Recurring Payees on a periodic basis, making regular Payments is quick and easy. The Payee field defaults to a Recurring Payee of the Payment Type specified which allows many recurring Payments to be made simply by selecting a Payment Type. This is possible because additional default values for other mandatory fields, such as the Amount, the Tax Deductibility of the Payment, and the Reference describing the purpose for which the Payment is being made, can be specified for each Recurring Payment record by the Administrator or a Director or Bookkeeper level User. The Enter Business Recurring Payment view appears below. This view is only accessible to the Administrator and to Director or Bookkeeper level Users.

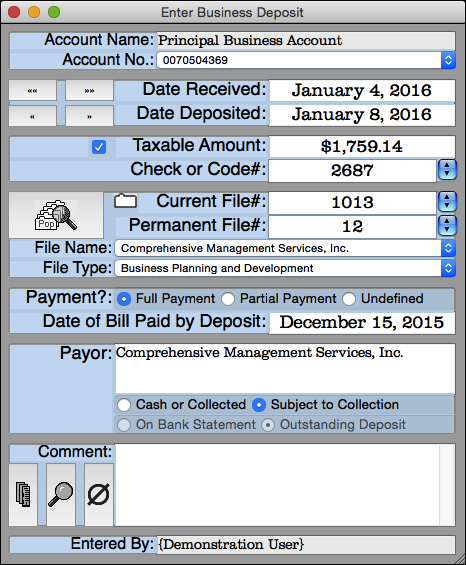

A separate Deposit record should be entered for each item deposited to record detailed information about each item. The Enter Business Deposit view is shown below. In this illustration the Deposit is of a check received in payment of a bill, and the name of the Payor is the same as the File Name.

The Date fields of new Payments and Receipts default to the date set on the system clock, and can be edited if appropriate. Deposit records contain two date type fields. One is the Date Received field that stores the date an item is received, and the other is the Date Deposited field that stores the date the item is deposited into the Bank Account. The Gross Receipts computation performed by the Income Statement is based upon the Date Deposited, and the past due balance computations performed when calculating the current amount due for billing purposes is based upon the Date Received.

Payment and Receipt Amounts may be entered in any numerical format, and Managing Director automatically formats the entry as a dollar amount within the field. When a Check is displayed using an entry type view, the Amount is translated by Managing Director into words which are displayed across the center of the Check in an open face font which is difficult to alter when printed, and on the two stubs in an easily read serif font. This dual display of the Amount of Checks in both numbers and words aids Users in recognizing easily made keyboarding errors, such as adding an extra zero or not typing a decimal point before entering cents. It also gives printed Checks a more professional appearance without requiring the User to tediously type the Amount in words.

Managing Director computes Account Balances in two independent ways. One is based upon a sequence of Bank Account Starting Data records automatically created for each Bank Account when it is reconciled against the statement issued by the bank. These multiple Starting Records for each Bank Account are stored separately from the Check and Deposit records, and are used as permanent points of reference by Managing Director. When computing Bank Account Balances, all subsequent Deposits into the Account are recalled and added to the Starting Balance of the Active Bank Account Starting Data record, and subsequent Checks drawn from the Account are recalled and deducted. Any Bank Account Starting Data record may be made Active or Inactive at any time. This allows the Administrator to recompute the Current Balance from the inception of the Bank Account if desired, or to isolate an error or inconsistency between two Bank Account Starting Data records. Use of these independent Bank Account Starting Data records avoids the need to periodically archive or purge Bank Account records, and is one of the reasons Managing Director never requires Users to define or close accounting periods of any kind. The second method of computing Bank Account Balances used by Managing Director is based upon a simple “post” operation. Although this method is much quicker, it is also less reliable. The Amount of a Check or Deposit is subtracted from or added to a single field at the time of entry. If this post operation is unsuccessful due to a system error or because the Bank Account record is open and therefore write locked, the posted balance will become incorrect, and will stay that way until corrected. The Administrator may easily correct the posted balance by using the Enter Bank Account view to display the relevant Bank Account record, clicking the check box to the left of the Compute Current Balance label which causes the Posted Current Balance to default to the Computed Current Balance, deleting the incorrect Posted Current Balance, and then replacing the edited Bank Account record. Alternatively, Managing Director will automatically correct the Posted Current Balance when the Bank Account is successfully reconciled against the bank statement and the Reconcile Bank Account view is printed by clicking the command button on the view. Since Managing Director simultaneously utilizes these two methods of computation, the Administrator may choose either method for each Bank Account at any time. Thus, the Administrator chooses whether to regularly use the Posted or Computed Current Balances when validating Check Amounts.

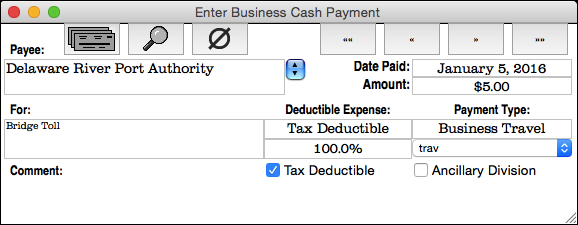

Business Payments not made from a Business Bank Account are recorded as Business Cash Payment records. Like Business Checks, Business Cash Payments are assigned a Payment Type, and a Tax Deductibility. The Enter Business Cash Payment view is shown below.

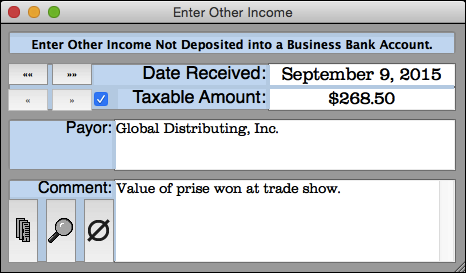

Income realized but not deposited into a Business Bank Account is recorded as Other Income records. Like Business Deposits, the taxability of Other Income is set in each record. On the Income Statement, Taxable Other Income for the date range specified appears on a separate line and is included in the Total Income computation. The Enter Other Income view is shown below.

To facilitate tax accounting and business planning, a self configuring Income Statement is accessible to Director level Users. This Income Statement defaults to a time period from the beginning of the current calendar year through the end of the current calendar month if accounting data have been entered for this period. The default period can be changed to any period of days for which accounting data have been entered by editing the default dates. The amounts reported are compiled from the original Payment and Receipt records. One column displays income and expense totals for the time period specified, and a second column automatically annualizes the first. The form of the Income Statement is patterned after the structure of an income tax return making the transfer of figures to the actual return simple and convenient. Most firms need only supplement these figures with depreciation and amortization schedules prepared on an annual basis.

Check Drafting and Printing

Bank Accounts

Payment Types

Multiple Type Checks

Payment Payees

Deposit Payors

Transaction Dates

Transaction Amounts

Bank Account Balances

Cash Payments

Other Income

Income Statement